User:ØverLørd/Thesis outline

Introduction

In this thesis I will explore how futures are commodified in prediction economies. First I will unpack how modern financial systems operate and how they came to be. Looking at historical examples that laid the foundation for statistics, monetary systems and stock markets. This will grant insights into the material conditions and ideas that formed the logics and beliefs that modern financial institutions rely upon in order to Function.

https://www.andreasaltelli.eu/file/repository/Jan_Hacking_Emergence_Probability.pdf the introduction part of this book is a nice format, that I can imagine that this sections format could resemble.

Secondly I will explore how these ideas are deployed in contemporary speculation markets. Unpacking how different types of financial instruments operate. Ultimately exposing how this system resemble something of a less empirical notion, a cult, highly reliant on beliefs, trust and promises.

Lastly we will look at some communities that embrace and engage with prediction economical logics in the form of stocks (and other forms of securities) and pokémon trading cards. This will explore what kind of rites and rituals these communities perform, through looking at what kind of information technological communications artifacts they produce and circulate.

Method

Like the graduation project I will work in a fragmented way, where I produce smaller bodies of text that describe relevant discrete events and theory. I think this will allow for a fertile dialogue between the making and the reading&Writing.

Key texts

CAPS LOCK to understand the relation between graphic design and capitalism. Pater, R. (2021). Caps lock : how capitalism took hold of graphic design, and how to escape it. Amsterdam: Valiz.

TechGnosis: explore the relation between information technology and spiritual imagination. Davis, E. (2015). TechGnosis : myth, magic & mysticism in the age of information. Berkeley, California: North Atlantic Books, Cop.

The Emergence of Probability: A book that explores how the discipline of probability emerged. Taking into account material conditions, both physical and ideological. Hacking, I. (n.d.). The emergence of probability : a philosophical study of early ideas about probability, induction and statistical inference.

Declarations of independence: This text is a philosophical and literary analysis of the declaration of independence by Jacques Derrida. Here Derrida questions the relation between the signature and the performative act of constituting an institution. http://ereserve.library.utah.edu/Annual/ENGL/5910/Horwitz/derrida.pdf

DEBT: Gives a broad overview over how captialism has evolved. "the story of capitalism is [...] how the economy of credit was converted into the economy of interest." (p332)

Graeber, D. (2011). Debt: the First 5,000 Years. Brooklyn, Ny: Melville House.

Wreading and Riting

Here are some fragments that eventually will become the thesis.

ETFs

Efficient market hypothesis

The EMH postulates that the trading price of an asset reflects all publicly available information, and thus it is impossible to systematically outperform the market over time (Unless you have some non-public information…). Since all relevant information is already taken into account when price is determined, and the only thing that will move it is new information.

In more colloquial language you can say that "everything is priced in", meaning that there are no obvious investments since prices are fair, and the only thing that would change it would be new information, which by nature is unpredictable.

This illustrates the markets intrinsic relation to flows of information. Where the market strives to be completely in sync with the present by absorbing any piece of new information quickly and reflect it in price.

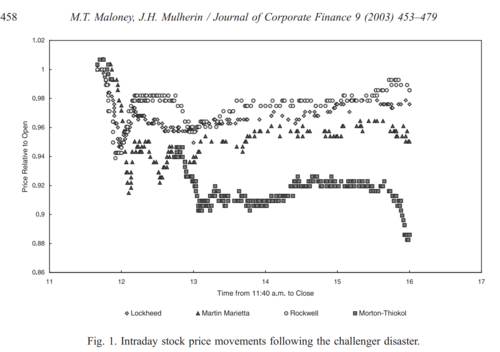

An example of this phenomena can be seen if we look at the stock prices of the companies that were contracted to build the Space shuttle challenger. The rocket exploded shortly after the launch on January 28, 1986. On the day of the disaster the stock price of the companies Lockheed, Martin Marietta and Rockwell international fell by 2-3%, whilst Morton another major contractor in the operation, fell by over 11%. Somehow the market had correctly figured out that Morton was most likely the company responsible for the failure, and therefore this was reflected in the price. Even though it would take months until any official investigations would uncover the cause of failure.

The application of this hypothesis questions the usefulness of conducting so-called fundamental and technical analysis. Both which are methods for forecasting future trends in stocks. Where the Fundamental analysis focuses on the intrinsic value of a security. Meaning assessing a company's real value, by looking at things like financial statements and company news, to determine how the company is doing. This kind of analysis is useful for determining if a stock is a good investment in a longer time-frame. Technical analysis on the other hand takes a more statistical approach to figuring out how a stock is doing, by evaluating looking at price movement and volume traded.

What the EMH suggest is that there is no need for fundamental analysis, as all the factors it looks at are already priced in, thus the analysis would not yield any new insights in the pricing of a stock. Technical analysis is also impaired since it looks at historical data, and according to the hypothesis only new information (which by nature is unpredictable) will move the price.

It is worth to mention that this is just a hypothesis and by no means a perfect model of the real world markets.

A speculative history of Stocks

This is by no means an accurate or complete account of how modern stock exchanges came to be, but it illustrates what kind of imagination and ideologies that prediction economies are founded upon.

Born out of imperialism and colonialism six companies merged and formed the Dutch was India company (VOC) in 1602. The company was concerned with (and quite successful) in monopolizing Dutch trade in Asia, using all means possible to fend off competitors like the Portuguese and British. The dutch government dazzled by the gleam of the financial potential of nutmeg and clove, were all aboard and issued the company exclusive rights to operations in Asia. In addition the company was allowed to declare wars, and subsequently enter treaties, on behalf of the highest Dutch government.

The business model of the VOC was quite simple, at the core they sent off ships to far away lands, where they exploited natural resources and local communities, in order to fill up their ships with commodities that the European market coveted. Upon returning to Europe the cargo would be auctioned off and profits were made. One challenge with this model was that the initial capital needed to buy ships, and hire people are big costs, and any returns on such investment would not be realized until the return of the fleet. Furthermore it could be a risky investment, traveling at seas for months and years, offered a plethora of dangers along the way like bad weather, disease, piracy and competing merchant fleets. This did not stop brave (and rich) merchants to gamble, in order to further grow their wealth. Thus it was common practice at the end of the 1500's for private groups to pool their money in order to finance such charters.

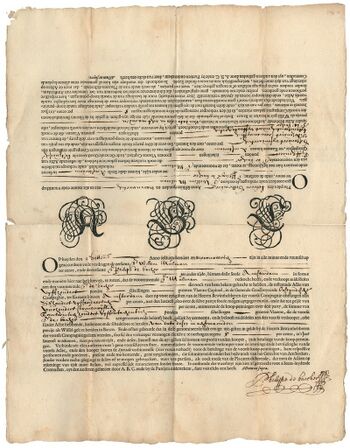

What set the VOC apart from these previous companies, was that they invited "All the residents of these lands […] May buy shares in this company" as stated in the founding documents of the company. In addition there was no required amount to invest, subscribers were allowed to decide for themselves. This meant that it was not only the already wealthy merchants and Nobels that could embark on this exciting business venture, but literally any "residents of these lands" (whatever that means) could be a part of it. A testimony to this is the fact that even the maid of one of the founders invested 50 guilders amongst 1,143 other investors for the initial capital of the Amsterdam branch of the VOC. (How liberating?)

Another unusual condition surrounding the VOC was the fact that their first charter was granted for 21 years. A long time compared to its predecessors who would usually operate for three or four years. Meaning that the shareholders money would be locked up for a long time! — Or would they? The company not wanting to deter investments due to long time horizons therefore included an extra provision in the "capital subscription register" that stated that the subscribed capital could be transferred to someone else.

A speculative history of price(tags) and money

This text was used as a way of contextualizing a colloquium, where we attempted to hack some digital price-tags.

Pricetags are techno-social interfaces that inform the consumer with the price of a certain product/service.

Price

A price is the (usually not negative) quantity of payment or compensation expected, required, or given by one party to another in return for goods or services.

Prices are influenced by production costs, supply of the desired product, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions.

One may think that the price of something should reflect its value, this is not necessarly true. Value could be understood as something inherent, whilst price is something that occurs in the framework of a transaction.

Marxists assert that value derives from the volume of socially necessary labour time exerted in the creation of an object. This value does not relate to price in a simple manner, and the difficulty of the conversion of the mass of values into the actual prices is known as the transformation problem.

another paradox of price is the so-called diamond – water paradox: diamonds command a higher price than water, yet water is essential for life and diamonds are merely ornamentation. described by Adam smith the founder of captialism (or atleast the author of The wealth of nations).

Price tags in a late capitalist society rely on a universally accepted form of payment, so to further understand what a price is, we also have to talk a bit about money, as this is the most common form of payment.

Money

We live in a society where we have to think about money all the time. some say money is good some say it's bad. Like it or not, it makes our world go 'round, and it is very hard to ignore.

so where does it come from? We can maybe all agree that its nice to be able to not have to acquire everything in life from the fibers in your toilet paper to the Europium and neodymium in our smart-phones all by yourself? Therefore it is very convenient that we have a universal good, something everyone wants, that you always know will allow you to barter for other stuff.

Way back people used a various of things like shells, nuts, seeds and livestock to trade in. Then at some point people became obsessed with metals, as they could be remade over and over to different tools. A common theme seems that useful things with long shelf-life, and maybe not too abundant so you wouldn't have to deal with massive quantities when shopping, makes good currecny. At a later point gold became the craze, and it became the meta when it came to making deals.

This offered new challenges, as it was sketchy and unpractical to carry around large quantities of gold, and people decided to instead give each other promises of amounts of gold on pieces of paper or leather or whatever they could write on. and at some point people decided that it would be better to have all the gold in one place, so all the gold exchanges could happen behind bars and thick walls. This lead to a system of banks around the world that would issue people pieces paper and (less valuable) metals, and promised that these could be exchanged for their denoted value in gold.

For a long time people liked the gold standard, as it made it so no one could just mint loads of cash for no reason, regulating the amount of money in circulation. The gold acted as a security making people trust the bank and that their money actually had value, as it was tied to the gold in the bank.

Then more time passed, and people were so extatic about beeing able to spend their hard earned cash on all sorts of exciting fruits and garments (Not to forget rent, food, and taxes++), that they didn't really care about the gold in the bank anymore. Besides everyone around you seemed to appreciate the money as much as you, so you forgot about the gold. And in the early 1900s (war was a common trigger) banks started disbandoning their promise to give people gold for their metal and paper pieces.

This marks a shift of where the value of the money came from. Where it before had an exchangeable intrinsic value equivalent in gold. Now the value of the money was derrived from the state. And implicitly peoples trust in the state.

This is what we call fiat-currency, A kind of fantasy money, that governments and banks can just issue out of thin air.

So what can we take away from this?

Prices are dubious and elusive, and so is money, and they can seemingly change all the time for no particularly clear reason, but just because of "market conditions". This volatility and the hunger to have the most competitive prices, has lead to the invention digital price tags. Rather than the cumbersome opertions of printing new price tags, the price can be changed all digitally! so how do they work?

CAPS LOCK

According to Caps Lock (Pater, 2021) the arrival of industrialization marked the beginning of professional design. Production of "designed" objects was up to this point mainly produced by skilled workers, (or people at home making stuff for themselves). Implicitly the arrival of mass production meant lower quality goods, but at a discount so people didn't mind. Some people DID mind, like the "revolutionary design schools of Europe, in particular the Bauhaus in Germany and VKhUTEMAS in Russia" (p. 322), and thus looking to unify art and industry whilst also stressing the social necessity of mass production. In other words the professional designer has to be concerned with market conditions, as these regulate the feasibility of mass production.

This means that the field of design as we know it today, in educational institutions, trade asociatiations and commercial In other words the western design hegemony was founded on something that balanced between industrial production (deployed on societal scale) and "art".