User:ØverLørd/Thesis outline

Introduction

In this thesis I will explore how futures are commodified in prediction economies. First I will unpack how modern financial systems operate and how they came to be. Looking at historical examples that laid the foundation for statistics, monetary systems and stock markets. This will grant insights into the material conditions and ideas that formed the logics and beliefs that modern financial institutions rely upon in order to Function.

https://www.andreasaltelli.eu/file/repository/Jan_Hacking_Emergence_Probability.pdf the introduction part of this book is a nice format, that I can imagine that this sections format could resemble.

Secondly I will explore how these ideas are deployed in contemporary speculation markets. Unpacking how different types of financial instruments operate. Ultimately exposing how this system resemble something of a less empirical notion, a cult, highly reliant on beliefs, trust and promises.

[Steve: Hey Victor. Thanks for your latest version. It’s great to see you extending the text. Great to see that you have all the elements to write the thesis to hand. However, there is work to be done on structuring the text. As a “thought experiment”, which we can discuss on Thursday, I have extended your introduction to incorporate the other things we have been talking about, and to help develop and structure the argument (performativity as financial instrument, cultural instrument, political instrument). This will require a synopsis of the Derrida text and of Culler’s overview of “the fortunes of the performative”. Suggested extension to the intro reads:]

“I will relate the notion of “speculative futures” in the financial markets to “performative speech acts” as discussed in cultural theory (see J. Culler, A.J.Austin, Judith Butler &c) and to theorists of the performative future such as Derrida (on the constitution). I will also make a relation to the “speculative futures” of writers such as Ursula K. LeGuin (Always Coming Home) and the “speculative futures” [“future building”—"future proofing”] of the discourse of high finance. I will examine them in their cultural unity (what they have in common, how they allow us to explain the world) at the beginning of the 21st century. I will outline how the performative serves a broader political-social reasoning which spans the world of finance and cultural theory.”

I suggest this as a way of rounding the argument so that all the things you discuss are in relation to "performativity". The text (below) is raising a number of subjects, all of which are relevant. The task, which is very doable, is to help build these elements into a rounded argument.Method: a) make synopsis of Culler; b) make synopsis of Derrida; c) outline LeGuin's novel. Use these as elements to articulate your argument at key points. Later, in the concusion, you can explain how performativity, in its multiplicity, informs how we understand (possible) futures.

Lastly we will look at some communities that embrace and engage with prediction economical logics in the form of stocks (and other forms of securities) and pokémon trading cards. This will explore what kind of rites and rituals these communities perform, through looking at what kind of information technological communications artifacts they produce and circulate.

Method

Like the graduation project I will work in a fragmented way, where I produce smaller bodies of text that describe relevant discrete events and theory. I think this will allow for a fertile dialogue between the making and the reading&Writing.

Key texts

CAPS LOCK to understand the relation between graphic design and capitalism. Pater, R. (2021). Caps lock : how capitalism took hold of graphic design, and how to escape it. Amsterdam: Valiz.

TechGnosis: explore the relation between information technology and spiritual imagination. Davis, E. (2015). TechGnosis : myth, magic & mysticism in the age of information. Berkeley, California: North Atlantic Books, Cop.

The Emergence of Probability: A book that explores how the discipline of probability emerged. Taking into account material conditions, both physical and ideological. Hacking, I. (n.d.). The emergence of probability : a philosophical study of early ideas about probability, induction and statistical inference.

Declarations of independence: This text is a philosophical and literary analysis of the declaration of independence by Jacques Derrida. Here Derrida questions the relation between the signature and the performative act of constituting an institution. http://ereserve.library.utah.edu/Annual/ENGL/5910/Horwitz/derrida.pdf

DEBT: Gives a broad overview over how captialism has evolved. "the story of capitalism is [...] how the economy of credit was converted into the economy of interest." (p332)

Graeber, D. (2011). Debt: the First 5,000 Years. Brooklyn, Ny: Melville House.

Wreading and Riting

Here are some fragments that eventually will become the thesis.

ETFs

A more contemporary financial instrument is the Exchange traded fund, or ETF, that saw it's debut in the markets in the 1990's. As the name suggests it is an investment fund traded on stock exchanges. The funds can be understood as baskets comprised of many different assets that share certain criteria. The largest ETFs (meaning the ones that are traded the most measured in money) usually track indexes, meaning that the performance of the ETF reflects the performance of the index. These indexes can represent certain industries or different geographical regions. Therefore the ETF allows an "investor" to allocate their money in particular markets that align with their beliefs and expectations.

So where do ETFs come from, you might ask? The biggest issuer of ETFs is Blackrock ishares and Vanguard. Both of which are amongst the biggest asset managers in the world, that hold and manage a substantial amount of all global shares. Together these two companies hold around 10% of all the shares in the world. These companies can then bundle up a bunch of shares, and start issuing ETFs which are then sold by brokers around the world.

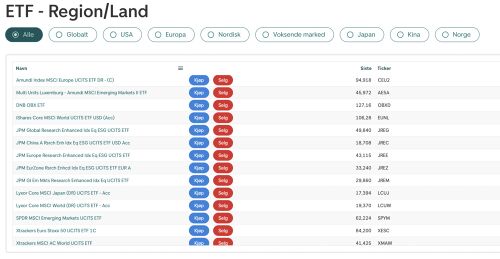

One such broker is DNB, one of the biggest consumer-banks in Norway. If we navigate their website to ETFS we are presented with the opportunity to place our wager on all sorts of different ideas. WE can invest in things like technology, sustainability or energy. All enticing prospects for us to grow our wealth.

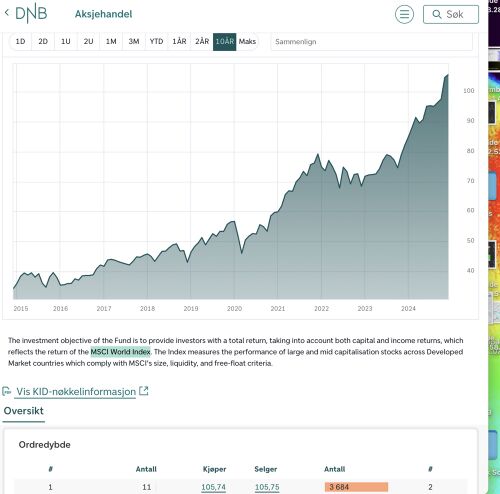

OR why not bet on a particular region. Heck why not just bet all our savings on the entire world? The world has to be doing good right? So it seems at least if we go into one of the ETFs and see the past performance, we can see that world has been subject to great growth! From 2015 til today the value of the world has nearly tripled in value!!

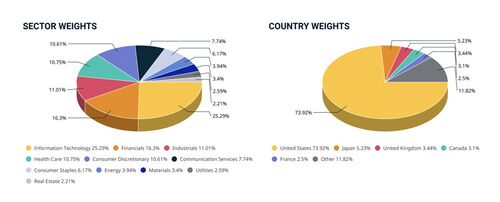

WE can see that this ETF is "tracking" the MSCI World index, which "measures the performance of large and mid capitalization stocks across Developed Market countries". So who, or what is this MSCI World index?

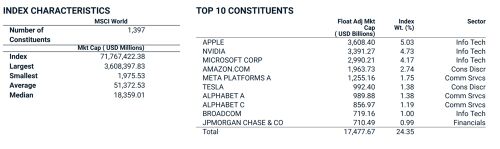

MSCI is an American finance company that help investors allocate and grow their funds, in the exchange for fees. Analysts and experts at MSCI have curated a collection of securities that somehow embody the global markets, and this curation of securities is MSCI world index. And it is this curation of securities that the ETF in question is trying to replicate, by being a collection of the same securities in the same proportions.

If we want to know more about what MSCI thinks constitute the world, MSCI has done the courtesy of offering factsheets online, with all their trading secrets. We can see which companies are the biggest constituents, we can see what kind of sectors the index is comprised off. We can even see which countries are represented. Here we can come to the interesting conclusion that the United States constitutes more than 70% of the world.

Efficient market hypothesis

The EMH postulates that the trading price of an asset reflects all publicly available information, and thus it is impossible to systematically outperform the market over time (Unless you have some non-public information…). Since all relevant information is already taken into account when price is determined, and the only thing that will move it is new information.

In more colloquial language you can say that "everything is priced in", meaning that there are no obvious investments since prices are fair, and the only thing that would change it would be new information, which by nature is unpredictable.

This illustrates the markets intrinsic relation to flows of information. Where the market strives to be completely in sync with the present by absorbing any piece of new information quickly and reflect it in price.

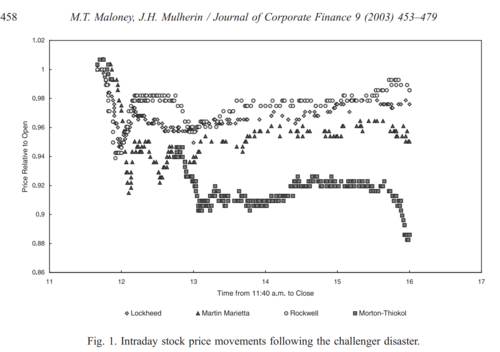

An example of this phenomena can be seen if we look at the stock prices of the companies that were contracted to build the Space shuttle challenger. The rocket exploded shortly after the launch on January 28, 1986. On the day of the disaster the stock price of the companies Lockheed, Martin Marietta and Rockwell international fell by 2-3%, whilst Morton another major contractor in the operation, fell by over 11%. Somehow the market had correctly figured out that Morton was most likely the company responsible for the failure, and therefore this was reflected in the price. Even though it would take months until any official investigations would uncover the cause of failure.

The application of this hypothesis questions the usefulness of conducting so-called fundamental and technical analysis. Both which are methods for forecasting future trends in stocks. Where the Fundamental analysis focuses on the intrinsic value of a security. Meaning assessing a company's real value, by looking at things like financial statements and company news, to determine how the company is doing. This kind of analysis is useful for determining if a stock is a good investment in a longer time-frame. Technical analysis on the other hand takes a more statistical approach to figuring out how a stock is doing, by evaluating looking at price movement and volume traded.

What the EMH suggest is that there is no need for fundamental analysis, as all the factors it looks at are already priced in, thus the analysis would not yield any new insights in the pricing of a stock. Technical analysis is also impaired since it looks at historical data, and according to the hypothesis only new information (which by nature is unpredictable) will move the price.

It is worth to mention that this is just a hypothesis and by no means a perfect model of the real world markets.

A speculative history of Stocks

This is by no means an accurate or complete account of how modern stock exchanges came to be, but it illustrates what kind of imagination and ideologies that prediction economies are founded upon.

Born out of imperialism and colonialism six companies merged and formed the Dutch was India company (VOC) in 1602. The company was concerned with (and quite successful) in monopolizing Dutch trade in Asia, using all means possible to fend off competitors like the Portuguese and British. The dutch government dazzled by the gleam of the financial potential of nutmeg and clove, were all aboard and issued the company exclusive rights to operations in Asia. In addition the company was allowed to declare wars, and subsequently enter treaties, on behalf of the highest Dutch government.

The business model of the VOC was quite simple, at the core they sent off ships to far away lands, where they exploited natural resources and local communities, in order to fill up their ships with commodities that the European market coveted. Upon returning to Europe the cargo would be auctioned off and profits were made. One challenge with this model was that the initial capital needed to buy ships, and hire people are big costs, and any returns on such investment would not be realized until the return of the fleet. Furthermore it could be a risky investment, traveling at seas for months and years, offered a plethora of dangers along the way like bad weather, disease, piracy and competing merchant fleets. This did not stop brave (and rich) merchants to gamble, in order to further grow their wealth. Thus it was common practice at the end of the 1500's for private groups to pool their money in order to finance such charters.

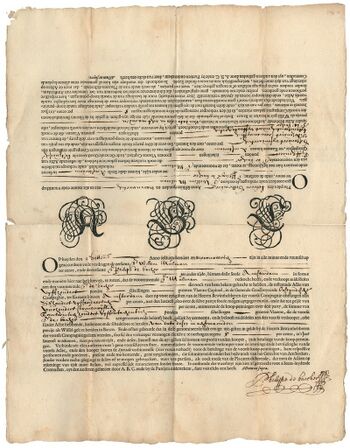

What set the VOC apart from these previous companies, was that they invited "All the residents of these lands […] May buy shares in this company" as stated in the founding documents of the company. In addition there was no required amount to invest, subscribers were allowed to decide for themselves. This meant that it was not only the already wealthy merchants and Nobels that could embark on this exciting business venture, but literally any "residents of these lands" (whatever that means) could be a part of it. A testimony to this is the fact that even the maid of one of the founders invested 50 guilders amongst 1,143 other investors for the initial capital of the Amsterdam branch of the VOC. (How liberating?)

Another unusual condition surrounding the VOC was the fact that their first charter was granted for 21 years. A long time compared to its predecessors who would usually operate for three or four years. Meaning that the shareholders money would be locked up for a long time! — Or would they? The company not wanting to deter investments due to long time horizons therefore included an extra provision in the "capital subscription register" that stated that the subscribed capital could be transferred to someone else.

Speculative money

We live in a society where we have to think about money all the time. some say money is good some say it's bad. Like it or not, it makes our world go 'round. When money is in short supply, or rather the circulation of it restricted, the world as we know it follows and stop functioning. In the sense that production and distribution of goods and services, that fuel the late capitalist consumeristic project (or fiction) we (children of the globalized world) are (involuntarily) participating in, is how "the world functions". The likes of which, was most recently observed in the months following the global pandemic of 2020, where ships literally stopped supplying global trade and unemployment skyrocketed.

(Some data that backs up the claims) https://fred.stlouisfed.org/series/UNRATE https://cpb.nl/en/world-trade-monitor-april-2024 https://www.wto.org/english/res_e/statis_e/trade_evolution_e/evolution_trade_wto_e.htm

so where does it come from? We can maybe all agree that its nice to be able to not have to acquire everything in life from the fibers in your toilet paper to the Europium and neodymium in our smart-phones all by yourself? Therefore it is very convenient to have a universal good, something everyone desires, that you always know will allow you to barter for other stuff.

This sentiment has laid the foundation of the understanding of history which the field of modern economics is built upon. This is made clear in David Rolfe Graeber's Debt: the first 5000 years, where they in the second chapter attempts to debunk "the myth of barter" (grabber, 2014). The author uses excerpts from different economic scholars to illustrate how the same story of societal development is regurgitated, in order to propel the narrative that trade for the benefit of the individual, is inherent to human nature. A narrative which is at the core of the belief system we today has come to know as capitalism, and "the great founding myth of the discipline of economics" (p. 25).

The story goes something like this: Way back, like way way back, when people first started to specialize in the production of things, whether shoes, arrows or food. People had to trade their surplus of goods for others, in order to sustain their daily conduct. Problems occur when one individual wants wants food, but only have shoes to trade, and the person with the surplus of food doesn't need shoes.

In other words, economic scholars say, that in such a system of barter a "double coincidence of wants" (p. 22) is conditional for a trade to proceed — very inconvenient when all humans want to do is make deals to their own benefit.

The story then continues: that any sensible person, when faced with the inconvenience of barter would keep a stash of "a certain quantity of some one commodity or other, such as he imagined that few people would be likely to refuse in exchange for the produce of their industry." (Smith, 1776, Wealth of Nations I.4.2) Hence the invention of money primarily as a medium of exchange.

As Graeber points out this narrative is a complete fiction, that "always begins with a fantasy world of barter" (p. 23). A common trait in the imagination of the authors of such stories is that these early societies of barter are often incorporated in systems of "patriarchal households, on good terms with each other, but who keep their own supplies." (p. 35). A structure much more resemblant of contemporary societies, than how ethnographic studies suggest that economic life actually was conducted "way way back". To illustrate this the author, whom is a anthropologist, describes exchange rituals amongst the indigenous Nambikwara people of Brazil and the Gunwinggu of the western Arnhem Land in Australia. Through the accounts, it becomes clear that these exchanges are not about getting the commodity high-ground, but rather hold social and political importance, involving complex cultural and social customs, and no money. Outright disproving the proposition that exchange for the individuals' benefit being human nature, leading to the invention of money.

Graeber, D. (2014). Debt: the first 5,000 years. Brooklyn: Melville House. Smith, A. (1776). The Wealth of Nations. Adam Smith.

Price (just some random excerpts)

This text was used as a way of contextualizing a colloquium, where we attempted to hack some digital price-tags.

Pricetags are techno-social interfaces that inform the consumer with the price of a certain product/service.

A price is the (usually not negative) quantity of payment or compensation expected, required, or given by one party to another in return for goods or services.

Prices are influenced by production costs, supply of the desired product, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions.

One may think that the price of something should reflect its value, this is not necessarly true. Value could be understood as something inherent, whilst price is something that occurs in the framework of a transaction.

Marxists assert that value derives from the volume of socially necessary labour time exerted in the creation of an object. This value does not relate to price in a simple manner, and the difficulty of the conversion of the mass of values into the actual prices is known as the transformation problem.

another paradox of price is the so-called diamond – water paradox: diamonds command a higher price than water, yet water is essential for life and diamonds are merely ornamentation. described by Adam smith the founder of captialism (or atleast the author of The wealth of nations).

Price tags in a late capitalist society rely on a universally accepted form of payment, so to further understand what a price is, we also have to talk a bit about money, as this is the most common form of payment.

CAPS LOCK

According to Caps Lock (Pater, 2021) the arrival of industrialization marked the beginning of professional design. Production of "designed" objects was up to this point mainly produced by skilled workers, (or people at home making stuff for themselves). Implicitly the arrival of mass production meant lower quality goods, but at a discount so people didn't mind. Some people DID mind, like the "revolutionary design schools of Europe, in particular the Bauhaus in Germany and VKhUTEMAS in Russia" (p. 322), and thus looking to unify art and industry whilst also stressing the social necessity of mass production. In other words the professional designer has to be concerned with market conditions, as these regulate the feasibility of mass production.

This means that the field of design as we know it today, in educational institutions, trade asociatiations and commercial In other words the western design hegemony was founded on something that balanced between industrial production (deployed on societal scale) and "art".