User:ØverLørd/Project proposal: Difference between revisions

| (39 intermediate revisions by 2 users not shown) | |||

| Line 1: | Line 1: | ||

[[SteveSuggestsVictor]] | |||

== Project proposal == | == Project proposal == | ||

''Construction site! Unauthorized Personnel Prohibited'' | ''Construction site! Unauthorized Personnel Prohibited'' | ||

=== What do you want to make? === | |||

I want to create a series of artifacts that tell a story about a fictional cult based in the far future. The artifacts are both found and constructed objects. | |||

The cult researches the commodification of (the) future(s), through the interrogation of information technological artifacts that somehow embody future. Exploring what kind of imagination, logic and ideology these artifacts imply, utilizing a media archeological methodology. | |||

The cult is based in the far far future, in such a far future they don't have the current context and references, therefore they understand the artifacts in different (sometimes comedic) ways. | |||

examples can be objects of speculation like stock options, pokémon trading cards, crypto currencies. It can also be simulations like video-games and stock trading simulator: https://hub.xpub.nl/chopchop/~v/stonks/ | |||

The project will draw from economics, statistics and particular online communities dedicated to speculation, to explore the relation between human psychology and (market)value, and how this is permeated and shaped by the information technological landscape. | |||

====Public moment==== | |||

''For the public moment a corporate seance was staged. It was comprised of a brochure, a display of artifacts that describe and predict the future, and a form to sign up for future membership.'' | |||

=====Brochure===== | |||

The brochure is a fictional fragment that presents an organization trapped in a future without past or present. The organization is interested in reconnecting their future with the rest of time. To do this they want to find out how the disconnect happened. Therefore they are studying archeological objects from the time they believe the future got detached. | |||

The brochure then presents different artifacts the organization has uncovered, in image followed by small descriptions. The descriptions play on the inherent logic of the different artifacts (e.g. a trading card being a currency, or video game being a training-simulation), but since the organization is based in such a far future they don't have the same context and references, they understand the objects in different (sometimes comedic) ways. | |||

''Excerpt from brochure:'' | |||

'''Organization for a unified far far future and present''' | |||

'''Who are we?'''<br> | |||

We are an organization based in the future, more specifically the far far future. Such a far future, that it has become detached from time. In this future there is no past nor present, there is only future. | |||

'''Our Mission'''<br> | |||

As you can imagine a disconnected future is very uncertain. Therefore we intend to reunite the future with time. We believe that understanding how this happened, is the key to reach our goal. | |||

'''Artifacts'''<br> | |||

Our research may suggest that the shift happened somewhen around the transition between the Holocene and the Anthropocene period. | |||

we have uncovered some artifacts, from the era in question, that we intend to interrogate. | |||

We want to research how these artifacts were used to predict, vision and engage with the future. | |||

=====Artifacts===== | |||

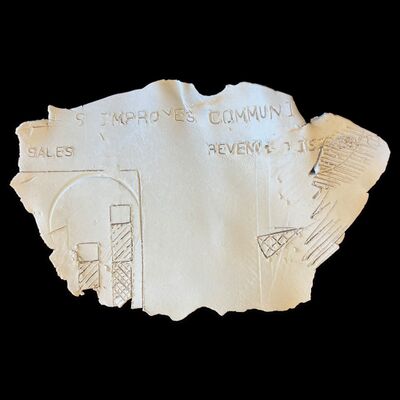

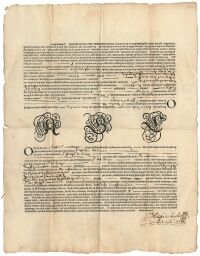

'''Artifact 1 — Petrified document''' | |||

[[File:Artifact1.jpg|400px]] | |||

A piece of a petrified document that speaks of prophecies for the future of sales and revenues. | |||

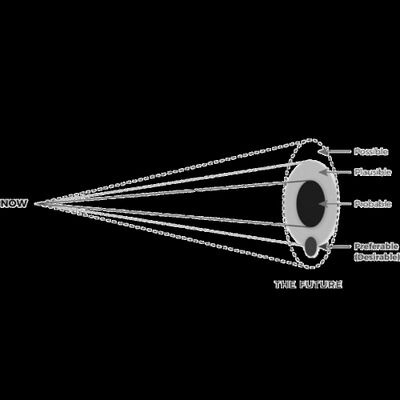

'''Artifact 2 — future cone''' | |||

[[File:Artifact7.jpg|400px]] | |||

A device for visualising possible futures. These were used for agents who wanted to promote a certain future. Here we can see that the present is a represented by a point, whilst the future is ever-expansive possibilities. | |||

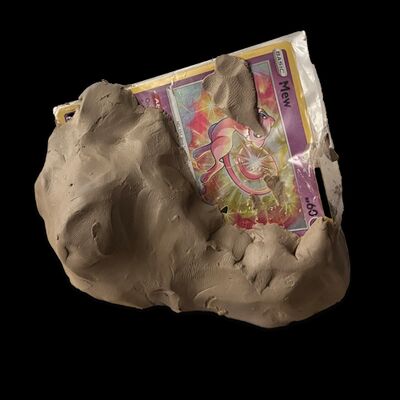

'''Artifact 3 — “Pokemon TCG”''' | |||

[[File:Artifact2.jpg|400px]] | |||

People would horde them, and went to great lenghts to protect the cards and their “newness“. People would hold on to the cards for the future, anticipating its’ value to increase. It might have been used as a form of currency. | |||

'''Artifact 4 — Forward-Looking Statements”''' | |||

[[File:Artifact4.jpg|400px]] | |||

This textual device accompanied analysis and projections for the future. Giving information on how to the future should be interpreted and refferred to in writing. | |||

'''Artifact 5 — Digital currency display''' | |||

[[File:Artifact3.jpg|400px]] | |||

We are not exactly sure what this device was used for, some experts speculate that it could have been some form of storage device for digital currency, a so called “crypto-wallet”. More research is needed… | |||

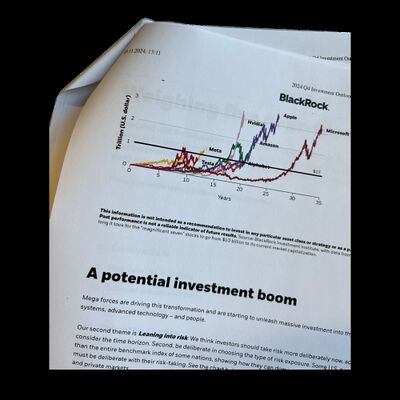

'''Artifact 6 — “Blackrock” document''' | |||

[[File:Artifact5.jpg|400px]] | |||

This document explores potential futures. An interesting thing to note from this artifact is how it explains how the past is not a good indicator for the future. A testimony of the future departing from the past. | |||

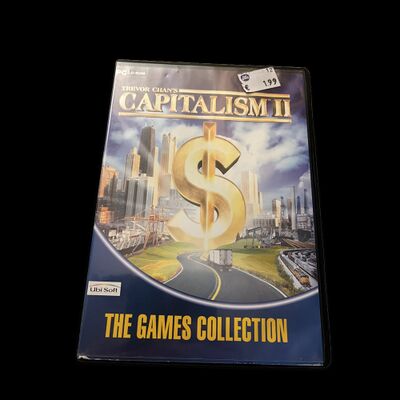

'''Artifact 7 — “Capitalism 2“''' | |||

[[File:Artifact6.jpg|400px]] | |||

This device stores digital data, we are able to decode this data. Revealing the contents of to be some sort of simulation. Through these simulations you could test different futures. The device was probably used for some sort of training. | |||

=====Form===== | |||

The form allows you to sign up for future membership. It is comprised of a few simple questions like name and e-mail adress. As well as asking "Where do you see yourself in the far far future?". | |||

=== How do you plan to make it? === | |||

Research the logic and history of future commodification, by looking into theory from economics like:<br> | |||

Efficient market hypothesis<br> | |||

origins of futures trading<br> | |||

financial derivatives market<br> | |||

Secureties contracts<br> | |||

Methodology for forecasting — technical and fundamental analysis | |||

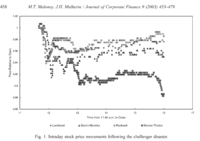

Through the research I will uncover found artifacts for fictionalization, in the form of graphs, contracts and reports, here are some examples: | |||

[[File:Challenger-stock_price_movements-allday.png|200px]] | |||

[[File:Oldforwardcontract.jpg|200px]] | |||

[[File:Recessionprediction.png|200px]] | |||

Based on my findings I want to make artifacts that play on the logic of prediction economies. | |||

The cult manifests itself in a corporate cloak, with brochures and forms, gathering e-mails for an e-mail list. Then it will further institutionalize through a website, that may offer services. The documents created in this process is a way of experimenting with what constitutes an institution, and intends to explore the performative "speech acts" that produce and frame reality through describing it. | |||

Later on the cult will engage with the public from the mailing-list, possibly inviting others to contribute to the fiction or maybe making some sort of time-capsule. | |||

=== What is your timetable? === | |||

September - April: | |||

Researching prediction economies and the relation between information technology and the spiritual imagination. | |||

September - November: | |||

Initial ideation and prototyping some artifacts: | |||

leading up to the public moment, where the cult has it's first public intervention. | |||

November - February: | |||

Further flesh out the cult, making a website | |||

Create more artifacts, write more fiction | |||

March: | |||

Find out what format suits the engagement with the public from the mailing list and plan an intervention. | |||

(it could be a workshop, discussion group, an exhibition or making of a time capsule…) | |||

April: | |||

Carry out the planned intervention. | |||

May-June: | |||

Finalize the website with the results of the intervention, finalize any artifacts, flesh out all the fiction. package it all up in a nice wrapper be it digital or physical (most likely post-digital). | |||

=== Why do you want to make it? === | |||

===== The format ===== | |||

By framing it within a cult I can work with "conventional" visual communications like web and print, something which has always been a foundation in my practice. Whilst the format of constructing fragments (artifacts) will also allow me to experiment with different tools and techniques through the year, and allow for a dialogue between the research and the making. | |||

===== Market & Value ===== | |||

At the surface something that intrigues me is the fact that the stock value of a company seems to dictate the how it runs. take for example intel, a company that has been leading in the production of semi-conductors due to various factors like losing to competitors overseas and being late to the Intergrated-AI-chip-party, saw a drastic fall in stockprice for the Q2 erarnings anouncment of 2023. In order to combat this, the CEO announced in the beginning of september that there will be "restructuring" - a fancy term for saying that jobs will be cut, parts of the company dissolved and production reduced. It seems like in the case of the big billion-dollar companies the most important thing is to keep the stock-price stable rather than running a company in a "good" way. | |||

The relation between cause and effect seems very blurred. I think this resonates with me as I previously have explored how media controls narrative, or how atleast how these things seems like self feeding systems: like how media protrays a certain (doomsday) reality of this world, and then this narrative is internalized amongst the populus, and becomes reality, which in turn feeds the media… Is similar to how the stock price of a company determines how well the compnay is doing, which in turn affects investors trust in the company, and effectivly how much money is put in to the company, that determines how well the company is doing. | |||

===== The financial cult of r/wallstreetbets===== | |||

The financial world seems like an alternative reality, a strange religion with even stranger rites and rituals. buying and selling confusing contracts, betting against each other and the market. A cynical echo-chamber where one persons loss is another ones win. | |||

A part of this cult that I have observed is the one found on the subreddit "wallstreetbets" a subreddit that became infamous in the beginning of 2021 for pumping the price of gamestop. Gamestop was steadily stearing towards bankrupcy, leading a lot of investors and the financial mainstream to short it (bet against the company, by borrowing a share and selling it at the current value, "predicting" that share to fall in value). The memelords of reddit managed to organize a socalled short-squeeze, where redditors around the world were encouraged to buy gamestop stocks and hold them (diamond hands), leading to a sharp increase in price, forcing all the short-holders to close their postion at a loss. This hurt some hedge-funds and the short sellers, a truly inspiring action against the biggest fish in the sea. | |||

Today the subreddit is mainly people posting so-called "loss/gain-porn" bragging about how much the made or lost. It is an echo-chamber that celebrates the glorified gambling that mobile-trading platforms have fostered. In the comments you can find heaps of ironic investment advice, that tells you how you can gamble away all of your money, in the quickest way possible. Another ting you will find here is so-call D&D—duediligence on obscure biotech-companies that may strike gold at the end of the next quarter, and why you should gamble all your savings with them. Another macabre artifact of this strange corner of the internet is all the suicide help-resources promoted in this subreddit. | |||

In this cult money becomes completely abstracted, only correlating with lines and numbers. It is completly distached from labour, and becomes its own meta game, hyper-money, hyper-value. leading to the development of some interesting conspiracies, like how certain trends of global indexes like the NASDAQ and S&P500 and combination with the trends of unemployment-rates "are EXACTLY the same as right before the 1929-depression". | |||

=== Who can help you and how? === | |||

Steve my supervisor <br> | |||

Fellow students interested in fiction and or simulation(games) <br> | |||

Jasper Siverts, an artist whom I have collaborated with on a project called weather forecast that explored possible futures for the National Museum in Oslo. <br> | |||

Jin Bin Chen, an artist whom I have collaborated on multiple occasions on a project that explores fan-fiction from internet communities. <br> | |||

Joseph – has experience with institutionalizing <br> | |||

The public from my collection of e-mails | |||

=== Relation to previous practice === | |||

'''BA-Project''' | |||

For my bachelors project I made a post-apocalyptic web-based fiction, that explored siumaltion and (hyper)reality: https://vus.netlify.app/thesimofreal/index_v2 | |||

'''SI 24''' | |||

In the Counter tourist information center I explored the creation of a fictional corporate entity. Engaging in developing different aspects of the visual identity, in the form of brochures, website and other marketing objects. As well as creating the ministry of the infraordinary… | |||

'''SI23''' | |||

How did we get here — was an exploration in storytelling through a multimedia installation, comprising both printed, digital(web) and performative components. | |||

'''Media Archeology''' | |||

Throughout my time at Xpub I have been curious about obsolete media and media archeology. Through explorations with pen-plotters, clay-tablets and radio. | |||

'''Weather forecast''' — A project by Artist Jasper Siverts, where I was a collaborator. The project was concerned with the future for National gallery in Oslo. The artist gathered predictions for the museum in a 100 years from artists, curators, clairvoyants, futurologists and venture capitalists. The predictions where then acted out by performers in the Museum. My role was making a publication that acted like a sort of script, where I experimented with letting the text itself be performative in it's formatting. A sort off concrete poetry. | |||

'''Omegaverse''' — A project by JinBin Chen, Where I have collaborated on multiple occasions. The project is based on internet fiction, and the artist paints this reality. In this project I have made different documents that also build and describe this fictional universe. | |||

=== Relation to a larger context === | |||

In a world governed by flows of information, everything can be quantified. This quantifiction is used by governments and corporations in order to model, analyze and predict. | |||

The way the world is mediated through statistics; Take for example the American election, where polls are used to indicate (or predict) outcomes. The polls themselves tap into the beliefs and confidence of people, propagating a desired reality. | |||

"Speculation is at the core of the financial system. (Pater, 2021 p.402)" What this means is that money in financial systems, are made through placing your money in some asset with and expectation that this asset will in the future fetch a higher price. These financial markets are usually secondary, as in the do not directly funnel the money into the production/operation of said asset, but rather entail the exchange of securities and contracts derived from the asset. | |||

This way of anticipating the future based on profits has heavily influenced professional design, in the sense that designer is expected to anticipate trends in order to make something sellable tomorrow. | |||

=== References/bibliography === | |||

'''CAPS LOCK''' to understand the relation between graphic design and capitalism.<br> | |||

Pater, R. (2021). Caps lock : how capitalism took hold of graphic design, and how to escape it. Amsterdam: Valiz. | |||

'''TechGnosis:''' explore the relation between information technology and spiritual imagination.<br> | |||

Davis, E. (2015). TechGnosis : myth, magic & mysticism in the age of information. Berkeley, California: North Atlantic Books, Cop. | |||

'''The Emergence of Probability:''' A book that explores how the discipline of probability emerged. Taking into account material conditions, both physical and ideological.<br> | |||

Hacking, I. (n.d.). The emergence of probability : a philosophical study of early ideas about probability, induction and statistical inference. | |||

'''Declarations of independence:''' This text is a philosophical and literary analysis of the declaration of independence by Jacques Derrida. Here Derrida questions the relation between the signature and the performative act of constituting an institution. <br> | |||

http://ereserve.library.utah.edu/Annual/ENGL/5910/Horwitz/derrida.pdf | |||

'''Always coming home:''' A fiction that may serve as inspiration in building the fiction. As it is a story about someone who conducts some sort of anthropological or ethnographic study of industrictible artifacts that survived an apocalypse, like styrofoam. The original copy included a tape of the future language and future music, as an interesting way of building the ficiton. <br> | |||

Leguin, U. (1986). Always coming home. London: Gollancz. | |||

https://www.suzannetreister.net/ALCHEMY/ALCHEMY.html – a project by suzanne Treister where she created alchemical drawing based on magazines. A way of speculating with contemporary media… | |||

https://lenaviolettaleitner.com/en/izmp/ — An immigration center for plants. Serves as an example of how one can institutionalize. | |||

https://en.wikipedia.org/wiki/World3 a project by the club of Rome that attempts to model the world. the project also produces the book "the limits to growth" | |||

''(maybe this could be interesting | |||

Why Nations Fail, Acemoglu, D. and Robinson, J.A. (2012). Why nations fail: the origins of power, prosperity and poverty. London: Profile Books.)'' | |||

Latest revision as of 15:39, 22 November 2024

Project proposal

Construction site! Unauthorized Personnel Prohibited

What do you want to make?

I want to create a series of artifacts that tell a story about a fictional cult based in the far future. The artifacts are both found and constructed objects.

The cult researches the commodification of (the) future(s), through the interrogation of information technological artifacts that somehow embody future. Exploring what kind of imagination, logic and ideology these artifacts imply, utilizing a media archeological methodology.

The cult is based in the far far future, in such a far future they don't have the current context and references, therefore they understand the artifacts in different (sometimes comedic) ways.

examples can be objects of speculation like stock options, pokémon trading cards, crypto currencies. It can also be simulations like video-games and stock trading simulator: https://hub.xpub.nl/chopchop/~v/stonks/

The project will draw from economics, statistics and particular online communities dedicated to speculation, to explore the relation between human psychology and (market)value, and how this is permeated and shaped by the information technological landscape.

Public moment

For the public moment a corporate seance was staged. It was comprised of a brochure, a display of artifacts that describe and predict the future, and a form to sign up for future membership.

Brochure

The brochure is a fictional fragment that presents an organization trapped in a future without past or present. The organization is interested in reconnecting their future with the rest of time. To do this they want to find out how the disconnect happened. Therefore they are studying archeological objects from the time they believe the future got detached.

The brochure then presents different artifacts the organization has uncovered, in image followed by small descriptions. The descriptions play on the inherent logic of the different artifacts (e.g. a trading card being a currency, or video game being a training-simulation), but since the organization is based in such a far future they don't have the same context and references, they understand the objects in different (sometimes comedic) ways.

Excerpt from brochure:

Organization for a unified far far future and present

Who are we?

We are an organization based in the future, more specifically the far far future. Such a far future, that it has become detached from time. In this future there is no past nor present, there is only future.

Our Mission

As you can imagine a disconnected future is very uncertain. Therefore we intend to reunite the future with time. We believe that understanding how this happened, is the key to reach our goal.

Artifacts

Our research may suggest that the shift happened somewhen around the transition between the Holocene and the Anthropocene period.

we have uncovered some artifacts, from the era in question, that we intend to interrogate.

We want to research how these artifacts were used to predict, vision and engage with the future.

Artifacts

Artifact 1 — Petrified document

A piece of a petrified document that speaks of prophecies for the future of sales and revenues.

Artifact 2 — future cone

A device for visualising possible futures. These were used for agents who wanted to promote a certain future. Here we can see that the present is a represented by a point, whilst the future is ever-expansive possibilities.

Artifact 3 — “Pokemon TCG”

People would horde them, and went to great lenghts to protect the cards and their “newness“. People would hold on to the cards for the future, anticipating its’ value to increase. It might have been used as a form of currency.

Artifact 4 — Forward-Looking Statements”

This textual device accompanied analysis and projections for the future. Giving information on how to the future should be interpreted and refferred to in writing.

Artifact 5 — Digital currency display

We are not exactly sure what this device was used for, some experts speculate that it could have been some form of storage device for digital currency, a so called “crypto-wallet”. More research is needed…

Artifact 6 — “Blackrock” document

This document explores potential futures. An interesting thing to note from this artifact is how it explains how the past is not a good indicator for the future. A testimony of the future departing from the past.

Artifact 7 — “Capitalism 2“

This device stores digital data, we are able to decode this data. Revealing the contents of to be some sort of simulation. Through these simulations you could test different futures. The device was probably used for some sort of training.

Form

The form allows you to sign up for future membership. It is comprised of a few simple questions like name and e-mail adress. As well as asking "Where do you see yourself in the far far future?".

How do you plan to make it?

Research the logic and history of future commodification, by looking into theory from economics like:

Efficient market hypothesis

origins of futures trading

financial derivatives market

Secureties contracts

Methodology for forecasting — technical and fundamental analysis

Through the research I will uncover found artifacts for fictionalization, in the form of graphs, contracts and reports, here are some examples:

Based on my findings I want to make artifacts that play on the logic of prediction economies.

The cult manifests itself in a corporate cloak, with brochures and forms, gathering e-mails for an e-mail list. Then it will further institutionalize through a website, that may offer services. The documents created in this process is a way of experimenting with what constitutes an institution, and intends to explore the performative "speech acts" that produce and frame reality through describing it.

Later on the cult will engage with the public from the mailing-list, possibly inviting others to contribute to the fiction or maybe making some sort of time-capsule.

What is your timetable?

September - April: Researching prediction economies and the relation between information technology and the spiritual imagination.

September - November: Initial ideation and prototyping some artifacts: leading up to the public moment, where the cult has it's first public intervention.

November - February: Further flesh out the cult, making a website Create more artifacts, write more fiction

March: Find out what format suits the engagement with the public from the mailing list and plan an intervention. (it could be a workshop, discussion group, an exhibition or making of a time capsule…)

April: Carry out the planned intervention.

May-June: Finalize the website with the results of the intervention, finalize any artifacts, flesh out all the fiction. package it all up in a nice wrapper be it digital or physical (most likely post-digital).

Why do you want to make it?

The format

By framing it within a cult I can work with "conventional" visual communications like web and print, something which has always been a foundation in my practice. Whilst the format of constructing fragments (artifacts) will also allow me to experiment with different tools and techniques through the year, and allow for a dialogue between the research and the making.

Market & Value

At the surface something that intrigues me is the fact that the stock value of a company seems to dictate the how it runs. take for example intel, a company that has been leading in the production of semi-conductors due to various factors like losing to competitors overseas and being late to the Intergrated-AI-chip-party, saw a drastic fall in stockprice for the Q2 erarnings anouncment of 2023. In order to combat this, the CEO announced in the beginning of september that there will be "restructuring" - a fancy term for saying that jobs will be cut, parts of the company dissolved and production reduced. It seems like in the case of the big billion-dollar companies the most important thing is to keep the stock-price stable rather than running a company in a "good" way.

The relation between cause and effect seems very blurred. I think this resonates with me as I previously have explored how media controls narrative, or how atleast how these things seems like self feeding systems: like how media protrays a certain (doomsday) reality of this world, and then this narrative is internalized amongst the populus, and becomes reality, which in turn feeds the media… Is similar to how the stock price of a company determines how well the compnay is doing, which in turn affects investors trust in the company, and effectivly how much money is put in to the company, that determines how well the company is doing.

The financial cult of r/wallstreetbets

The financial world seems like an alternative reality, a strange religion with even stranger rites and rituals. buying and selling confusing contracts, betting against each other and the market. A cynical echo-chamber where one persons loss is another ones win. A part of this cult that I have observed is the one found on the subreddit "wallstreetbets" a subreddit that became infamous in the beginning of 2021 for pumping the price of gamestop. Gamestop was steadily stearing towards bankrupcy, leading a lot of investors and the financial mainstream to short it (bet against the company, by borrowing a share and selling it at the current value, "predicting" that share to fall in value). The memelords of reddit managed to organize a socalled short-squeeze, where redditors around the world were encouraged to buy gamestop stocks and hold them (diamond hands), leading to a sharp increase in price, forcing all the short-holders to close their postion at a loss. This hurt some hedge-funds and the short sellers, a truly inspiring action against the biggest fish in the sea.

Today the subreddit is mainly people posting so-called "loss/gain-porn" bragging about how much the made or lost. It is an echo-chamber that celebrates the glorified gambling that mobile-trading platforms have fostered. In the comments you can find heaps of ironic investment advice, that tells you how you can gamble away all of your money, in the quickest way possible. Another ting you will find here is so-call D&D—duediligence on obscure biotech-companies that may strike gold at the end of the next quarter, and why you should gamble all your savings with them. Another macabre artifact of this strange corner of the internet is all the suicide help-resources promoted in this subreddit.

In this cult money becomes completely abstracted, only correlating with lines and numbers. It is completly distached from labour, and becomes its own meta game, hyper-money, hyper-value. leading to the development of some interesting conspiracies, like how certain trends of global indexes like the NASDAQ and S&P500 and combination with the trends of unemployment-rates "are EXACTLY the same as right before the 1929-depression".

Who can help you and how?

Steve my supervisor

Fellow students interested in fiction and or simulation(games)

Jasper Siverts, an artist whom I have collaborated with on a project called weather forecast that explored possible futures for the National Museum in Oslo.

Jin Bin Chen, an artist whom I have collaborated on multiple occasions on a project that explores fan-fiction from internet communities.

Joseph – has experience with institutionalizing

The public from my collection of e-mails

Relation to previous practice

BA-Project For my bachelors project I made a post-apocalyptic web-based fiction, that explored siumaltion and (hyper)reality: https://vus.netlify.app/thesimofreal/index_v2

SI 24 In the Counter tourist information center I explored the creation of a fictional corporate entity. Engaging in developing different aspects of the visual identity, in the form of brochures, website and other marketing objects. As well as creating the ministry of the infraordinary…

SI23 How did we get here — was an exploration in storytelling through a multimedia installation, comprising both printed, digital(web) and performative components.

Media Archeology Throughout my time at Xpub I have been curious about obsolete media and media archeology. Through explorations with pen-plotters, clay-tablets and radio.

Weather forecast — A project by Artist Jasper Siverts, where I was a collaborator. The project was concerned with the future for National gallery in Oslo. The artist gathered predictions for the museum in a 100 years from artists, curators, clairvoyants, futurologists and venture capitalists. The predictions where then acted out by performers in the Museum. My role was making a publication that acted like a sort of script, where I experimented with letting the text itself be performative in it's formatting. A sort off concrete poetry.

Omegaverse — A project by JinBin Chen, Where I have collaborated on multiple occasions. The project is based on internet fiction, and the artist paints this reality. In this project I have made different documents that also build and describe this fictional universe.

Relation to a larger context

In a world governed by flows of information, everything can be quantified. This quantifiction is used by governments and corporations in order to model, analyze and predict.

The way the world is mediated through statistics; Take for example the American election, where polls are used to indicate (or predict) outcomes. The polls themselves tap into the beliefs and confidence of people, propagating a desired reality.

"Speculation is at the core of the financial system. (Pater, 2021 p.402)" What this means is that money in financial systems, are made through placing your money in some asset with and expectation that this asset will in the future fetch a higher price. These financial markets are usually secondary, as in the do not directly funnel the money into the production/operation of said asset, but rather entail the exchange of securities and contracts derived from the asset.

This way of anticipating the future based on profits has heavily influenced professional design, in the sense that designer is expected to anticipate trends in order to make something sellable tomorrow.

References/bibliography

CAPS LOCK to understand the relation between graphic design and capitalism.

Pater, R. (2021). Caps lock : how capitalism took hold of graphic design, and how to escape it. Amsterdam: Valiz.

TechGnosis: explore the relation between information technology and spiritual imagination.

Davis, E. (2015). TechGnosis : myth, magic & mysticism in the age of information. Berkeley, California: North Atlantic Books, Cop.

The Emergence of Probability: A book that explores how the discipline of probability emerged. Taking into account material conditions, both physical and ideological.

Hacking, I. (n.d.). The emergence of probability : a philosophical study of early ideas about probability, induction and statistical inference.

Declarations of independence: This text is a philosophical and literary analysis of the declaration of independence by Jacques Derrida. Here Derrida questions the relation between the signature and the performative act of constituting an institution.

http://ereserve.library.utah.edu/Annual/ENGL/5910/Horwitz/derrida.pdf

Always coming home: A fiction that may serve as inspiration in building the fiction. As it is a story about someone who conducts some sort of anthropological or ethnographic study of industrictible artifacts that survived an apocalypse, like styrofoam. The original copy included a tape of the future language and future music, as an interesting way of building the ficiton.

Leguin, U. (1986). Always coming home. London: Gollancz.

https://www.suzannetreister.net/ALCHEMY/ALCHEMY.html – a project by suzanne Treister where she created alchemical drawing based on magazines. A way of speculating with contemporary media…

https://lenaviolettaleitner.com/en/izmp/ — An immigration center for plants. Serves as an example of how one can institutionalize.

https://en.wikipedia.org/wiki/World3 a project by the club of Rome that attempts to model the world. the project also produces the book "the limits to growth"

(maybe this could be interesting Why Nations Fail, Acemoglu, D. and Robinson, J.A. (2012). Why nations fail: the origins of power, prosperity and poverty. London: Profile Books.)